Thu Mar 07 2024 | 8 min read

The state of nature markets today and tomorrow

Author

Jason Eis

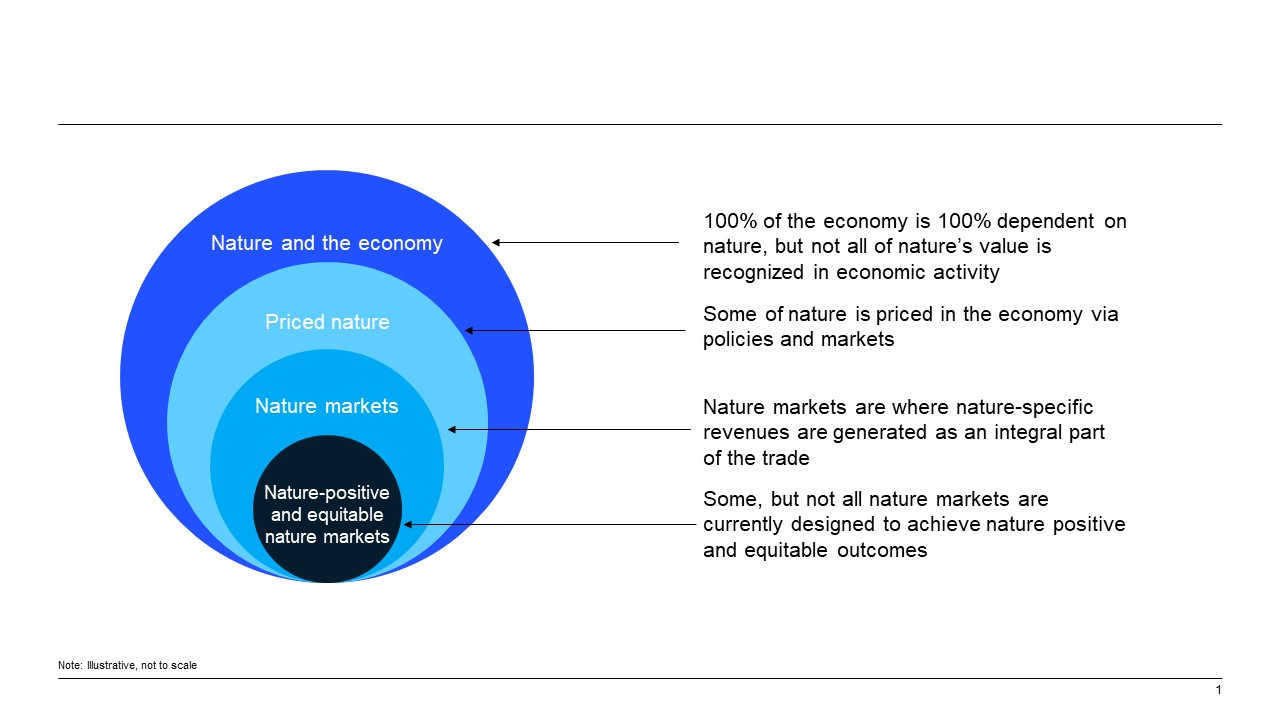

Nature markets make up $9.8 trillion worth of goods and services—equivalent to 11 percent of global GDP.1But the explicit value of nature in markets represents a fraction of nature’s true value. Nature markets are not well understood and often underprice the nature upon which they depend, leading to an inefficient use of natural resources despite their criticality throughout the global economy (Exhibit 1). Only a small segment of nature markets are currently designed to achieve nature-positive and equitable outcomes.

The negative consequences of this shortfall are likely also economic. For example, the World Bank estimates annual negative externalities of the global food system at $12 trillion per year, which is greater than the market value it generates.2A major contributor to those negative externalities is the damage the food system does to nature, which can sometimes result in inequity for different populations, especially indigenous groups and rural communities.3

Because of the complexity and importance of nature in the markets, governance, infrastructure and pricing mechanisms may require closer scrutiny and thoughtful implementation. Features like rules of trade, product and certification standards, taxes and subsidies, or systems of registry and exchange can drive incentives for companies to use nature in responsible ways. They also inform the potential impact of nature markets at scale.

This blog post summarizes the key findings of anew industry report, The Taskforce on Nature Market’sGlobal Nature Markets Landscaping Study, with insights and analysis by Vivid Economics by McKinsey. The report seeks to improve the collective understanding of nature markets by offering a clearer definition, assessing their current state and identifying trends, and discussing key implications for achieving nature-positive and equitable outcomes.

Source:https://uploads-ssl.webflow.com/623a362e6b1a3e2eb749839c/6242510f80c173df031c4d79_TNM_WhitePaper.pdf

The definition and types of nature markets

Despite broad literature that offers a diverse set of concepts related to nature and the economy, no widely agreed definition of “nature markets” exists today—which stymies attempts to research their size and impact on the economy.

Building on the definition provided by the Taskforce on Nature Markets,4the analysis defines a “nature market” as “a system composed of transactions between separate buyers and sellers, in which the transacted good or service specifically reflects a stock of ecosystem assets or a flow of ecosystem services from terrestrial or aquatic ecosystems.” This technical definition guided the market-sizing analysis5and facilitated the specification of four types of nature market: asset markets, intrinsic markets, credit markets, and derivative markets.

- Intrinsic marketsare markets in which provisioning, regulating, or cultural ecosystem services are traded, including commodity markets.

- Credit marketsare those in which credits that reflect efforts to enhance or conserve ecosystem assets or services are traded. These markets have primarily arisen in response to climate or nature-related policies.

- Asset marketsare markets in which the right to use ecosystem assets and their resulting services are traded. These markets require enforceable property rights and reflect demand for stable and long-lived value streams.

- Derivative marketsare those for financial products that directly reflect the value of ecosystem services or assets. Demand drivers vary substantially among products, but these markets reflect increasing recognition of nature’s values and the risks posed by nature loss.

The state of nature markets today and tomorrow

Although markets are not the only nor necessarily the most appropriate way to valorize nature, how nature markets function has a large impact on the economic incentives for conservation. To gauge how to best foster effective nature markets, an understanding of their extent, size, and distribution is needed.

Nature markets today

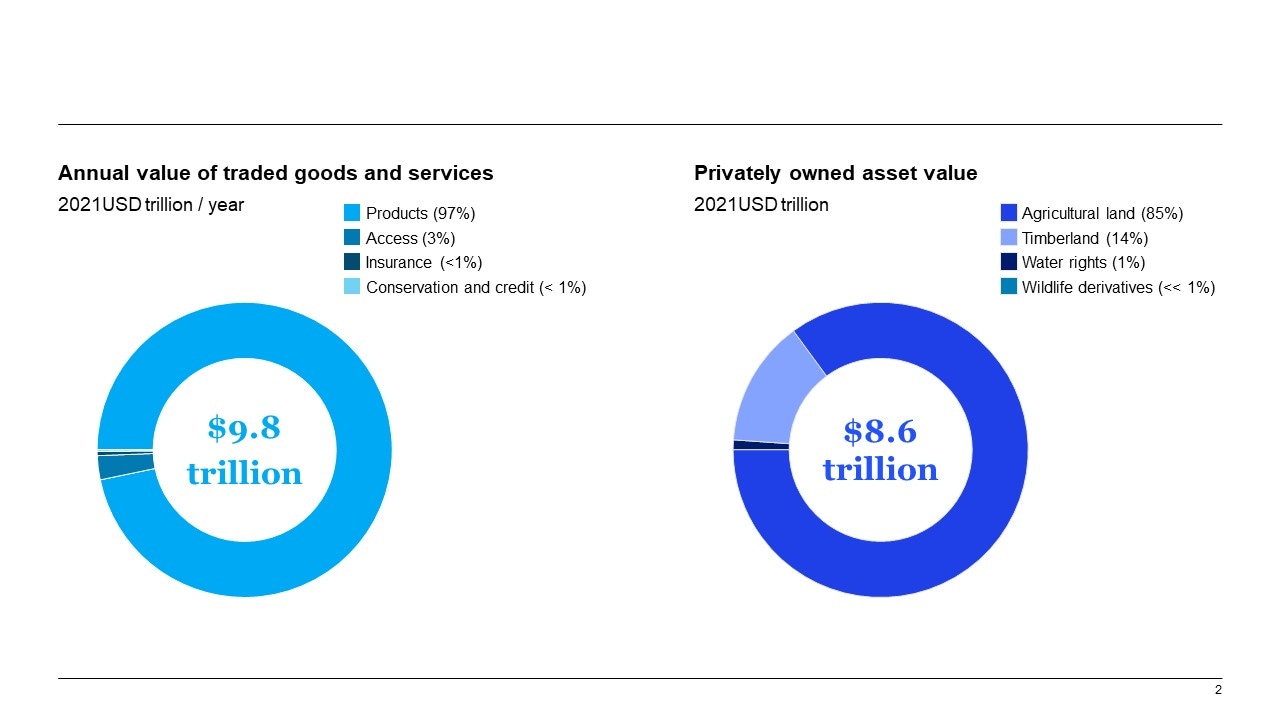

Currently, the world’s nature markets are worth $9.8 trillion,6driven by the value and scale of commodities production (Exhibit 2). Agricultural and extractive commodities account for over 90 percent of the product market. Their production is concentrated in large economies, with China, India, and the United States accounting for more than half of production value. Agricultural commodity segments with sustainable certification represent only a fraction of soft commodities production globally, although a growing percentage in some commodities such as palm oil and timber7. Such sustainably-certified market segments still face challenges in terms of standardisation and quality assurance around nature impacts.

While credit and conservation markets are growing and may be explicitly designed to achieve nature-positive outcomes, these markets currently represent less than 1 percent of the value of annual goods and services traded in nature markets, and have limited impact on the pricing of nature in agriculture and extractive commodity markets.

In addition, there are an estimated 1.2 billion hectares of privately owned and market accessible ecosystem assets, worth a combined $8.6 trillion. This value is also primarily driven by agricultural and soft commodities production, with 85 percent of the value attributed to agricultural land. The timberland market is growing rapidly, likely driven by demand for carbon credits and sustainable wood products. Hard and soft commodities also underpin $2 trillion in outstanding notional value of over-the-counter (OTC) derivatives contracts, which can be important risk management tools for buyers and sellers of commodities.

Note: Figures exclude commodity derivatives, as market size is measured using non-comparable metrics.

Nature markets tomorrow

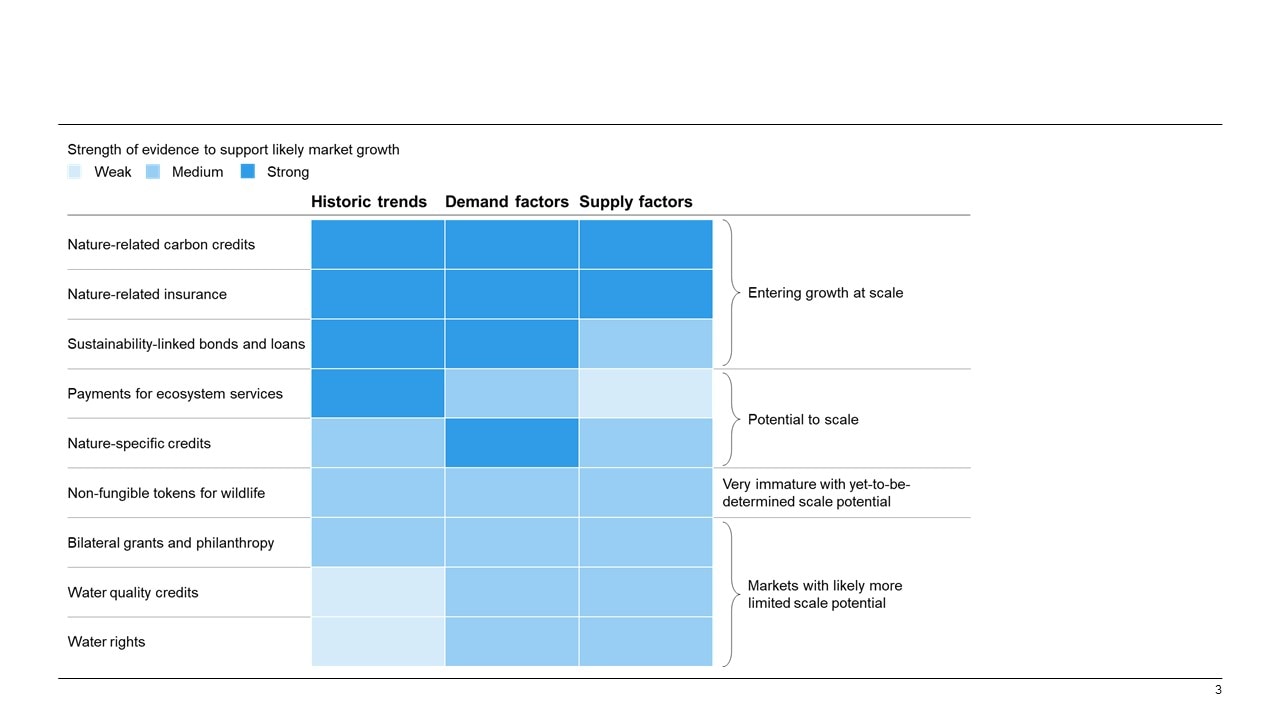

While nature markets already influence the global economy, the future of nature markets may look different than the present. As shown in Exhibit 3, historical trends do not provide a clear pattern of growth; however, climate change and consumer preferences may be key drivers of demand, and new technologies may facilitate a greater number and lower cost of transactions. Three nature markets: carbon markets, insurance and sustainability linked bonds, are now likely entering growth at scale while payments for ecosystem services and nature-specific credits are gaining traction.

Multiple nature markets are already seeing increased demand for ecosystem services that support climate change mitigation (e.g., carbon credits) and climate change adaptation (e.g., crop insurance).8Consumer, philanthropic, and investor preferences are also driving demand for financial products linked to sustainability outcomes (e.g., sustainability-linked debt), although climate change mitigation remains a greater focus than nature outcomes.9New technologies are also supporting the supply of new products and facilitating transactions in markets like nature-related carbon credits. However, many markets, particularly those that rely on monitoring and verification like payments for ecosystem services and biodiversity credits, still face challenges in credibly delivering outcomes and building consumer confidence.

The future of nature markets

Nature markets are already an important part of the economy, and there is a growing set of nature markets that explicitly price and trade nature—but those efforts are inconsistent, and there are opportunities in both established and emerging segments to better align nature markets with nature-positive principles.

The key will be market governance and market infrastructure. Including, for example, rules of trade, pricing mechanisms as well as systems of exchange and monitoring, reporting and verification.

In theory, nature should be priced consistently across markets, particularly those that are directly linked. For example, the prices in product markets (e.g., agricultural commodities) should be mirrored in the value of ecosystem assets (e.g., agricultural land). However, nature may be priced differently across markets due to differing policy regimes, market access, trade rules and other market distortions that can create mispricing.

Nature markets are also at different maturity levels and may require different types of governance supports to align with nature-positive principles. The market’s segments are heterogenous in size, distribution, governance, and impact on nature. Links between markets may affect incentives to embed nature-positive principles. For example, accessible and well-developed nature-related credit markets could create incentives for sustainable commodity production and natural asset management.

Most (although not all) of these markets can be classified into one of two categories: large mature nature markets or small immature nature markets.

- Mature marketsinclude agricultural commodities and commodity derivatives, which are already a major part of the global economy and financial system. These markets are not typically designed to achieve nature-positive outcomes.

- Immature marketstypically trade smaller volumes, and many of these segments are designed to achieve nature-positive outcomes through voluntary or compliance mechanisms, such as non-fungible tokens for wildlife.

As noted by the Taskforce on Nature Markets, markets at earlier stages of development, like nature-related carbon credits, may be subject to market-scaling challenges such as “monopolization, rent-seeking behavior, and problems related to informational gaps and asymmetries.”10

There is a set of critical questions that can be addressed for nature markets to ensure outcomes that improve biodiversity, preserve and build natural capital, and foster an equitable distribution of benefits:

- What is the extent of mispricing and illegal activity, such as illegal wildlife trade, across nature markets?

- To what extent do nature-related benefits and risks get priced into nature-related assets and downstream markets?

- What are the impacts of current nature markets on nature outcomes, and the scale of negative impacts in particular?

- What types of governance structures at the local and global level can most effectively shape nature markets and the use of nature in the wider economy?

- What standard setting structures for metrics, measurement, verification and certification can best enable efficient pricing of nature-positive and equitable outcomes?

- What disclosure and reporting structures can best enable transparent, nature-positive and equitable nature markets?

- What market infrastructure is required to support nature markets to scale and with sufficient transparency and safeguard mechanisms?

Related Blogs

Add your comment here

ADDRESS

Zero Carbon One

WY 82801, United States.

New Delhi - 110016, India. Noida - 201 301, India.

© 2026 — Copyright ZeroCarbon One

Zero Carbon One LLC

Zero Decarbon One Pvt. Ltd.